Opting Out of Healthcare

Steve Asmussen

June 21, 2017

If you’re a ScriptSave® WellRx member, you probably know only too well what it means to face high out-of-pocket costs for prescription medications. We hear this message from members every day and so it didn’t come as a huge surprise when we read details from a Bankrate.com survey.

If you’re a ScriptSave® WellRx member, you probably know only too well what it means to face high out-of-pocket costs for prescription medications. We hear this message from members every day and so it didn’t come as a huge surprise when we read details from a Bankrate.com survey.

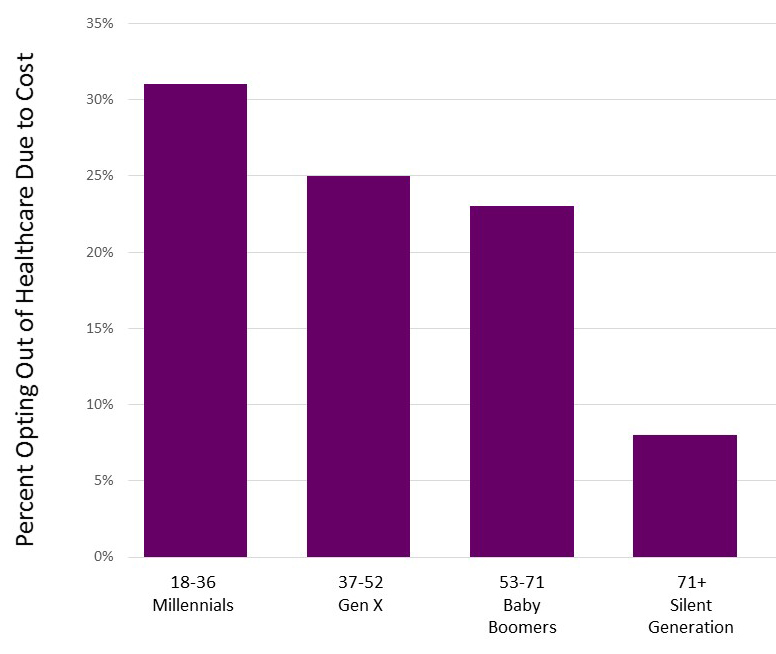

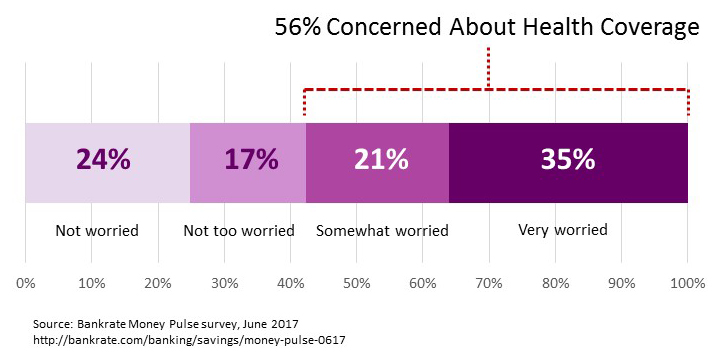

One quarter of surveyed Americans report that they, or someone in their family, have skipped vital medical care because of the cost. The Bankrate Money Plus Survey also revealed that more than half of those who responded worry about not being able to afford health insurance.

Health Care Anxiety

The survey findings come at a time of rising healthcare costs and huge increases in some health insurance premiums, while increasing insurance deductibles further weigh on the issue. In the survey, 56% say they’re either very or somewhat worried that they might not be able to afford health coverage in the future.

High-deductible Dilemma – An Expensive Healthcare Punt

High-deductible plans and HSAs (Health Savings Accounts) have been central in the healthcare debate. Such plans hype lower monthly premiums, as compared to traditional insurance. For many, this ends up being little more than an expensive punt (what gets ‘saved’ in premium costs comes back to bite many patients in the form of much higher out-of-pocket expenses when they submit a claim to their insurance provider).

In 2016 the average annual premium for employer-sponsored health insurance was $6,800 for single coverage in a preferred provider organization (PPO), according to data from the Kaiser Family Foundation (KFF).

By comparison, the average annual premium for a high-deductible health plan available through an employer was somewhat more affordable. KFF found that to be $5,762. The trade-off for the lower premium is that the consumer is responsible for saving the necessary amount of money needed to meet a higher deductible in the event of illness or requiring medical attention. In theory, under a high-deductible plan, employees can use a tax-advantaged HSA to cover qualified medical costs so these premium savings can be deferred, tax free, in order to meet future medical expenses. However, for many, this simply does not happen.

Saving Where You Can

No matter how the debate on healthcare reform ends up playing out, here are some things a savvy patient might wish to think about now to make the most of their existing insurance benefits:

|

References:

Recommended Articles